Did you ever look at your list of open jobs and wish you could “phone a friend” like contestants did on ‘Who Wants to be a Millionaire?’ This week’s blog suggests recruiting managers should phone a friend – their CFO – for help in making the case for increasing signing bonuses.

While headlines like the Walgreens $75k pharmacist signing bonus have slowed down since 2020 to 2021 when signing bonuses increased 454%, there is a good chance that your list of unfilled jobs is still too long and your time-to-fill KPIs are still in the tank.

Recruiting managers must continue using methods like increasing marketing and advertising spend, increasing referral bonuses, sharing jobs with staffing and search firms, and adding recruiter coverage. But often, the conversation turns to raising compensation, usually on top of already having raised pay only months before. Raising pay rates has severe unintended consequences. Korn Ferry writes about the ‘Great Pay Gap’ in which the dissatisfaction of once-loyal employees and issues of fairness emerge when new hires are paid more than the incumbent staff.

This situation is where the CFO and their team can help. Determining the pros and cons of using signing bonuses is not always an easy analysis. What is the break-even analysis on signing bonuses?

If you ask the CFO for their team’s help, they will likely build a spreadsheet model. Depending on your industry/jobs, the model can (and should be) very detailed, including:

- Signing bonus cost: This includes the actual amount of the bonus and any administrative costs related to processing and distributing the bonus.

- Length of employment: This is the amount of time that the employee is expected to remain with the company after receiving the signing bonus. Signing bonuses are almost always structured to be paid out over time, sometimes for as long as 5 years.

- Opportunity Cost (or lost revenue attributed to the unfilled job). In many service businesses, delivery to customers is severely impaired by worker shortages. This is a critical piece in this analysis and accounts for the highest signing bonuses in the market. Here is a list of the jobs with the highest signing bonuses from the summer of 2022. These jobs have the highest bonuses because the consequences of unfilled roles are so dramatic:

- Nursing: 18.1% of all job listings

- Driving: 15.1%q

- Dental: 14.7%

- Veterinary: 13.5%

- Medical technician: 12.6%

- Physicians and surgeons: 11.4%

- Childcare: 11.3%

- Personal care and home health: 11.3%

- Impact on productivity of the incumbent workforce. In some settings, the signing bonus contributes to Korn Ferry’s Pay Gap and may lead to more quiet quitting where the employee reduces their output leading to reduced service/revenue.

- Impact on retention and morale. Unlike quiet quitting, there is ‘loud quitting’ that follows poorly communicated signing bonus programs where the incumbents leave and take the competition’s job offer (which often include a signing bonus). This then drives more open jobs, reducing revenue and driving the need for still more signing bonuses. Best advice here; consider easing your compensation models into a structure where there is a long-term incentive component to support retention and reduce turnover costs.

We worked up an example using a salesperson and some simple assumptions:

- Let’s say a company is considering offering a $30,000 signing bonus to a new hire who is expected to generate $300k in annual gross profit after 3 years.

- The company estimates that the new hire will remain with the company for at least five years and, that for purposes of using an easy model, the signing bonus means the salesperson starts 1 year earlier than the non-signing bonus salesperson and, as a result, the later hire’s sales production is delayed a year.

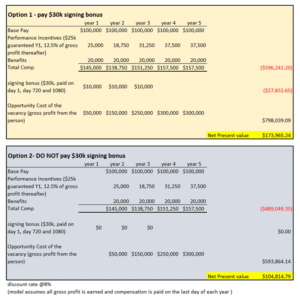

What is the $30k signing bonus worth? Most of us need an Excel pro to solve this properly. We created a simple model below, but for your firm, your finance team could put a model together in less than an hour if you partner with them on making some assumptions.

In this example, hiring the salesperson with the $30k signing bonus has a net present value of $174k vs hiring without the signing bonus having a net present value of $105k. The $30 signing bonus creates almost $70k of additional value! Why? With the signing bonus, the salesperson was put to work faster!

With simple spreadsheet like the one above, you could model all sorts of scenarios from the size of the bonus, payout timing, and most importantly, you can play out different timelines and add probabilities to outcomes (like will the salesperson really hit their mark in Year 3?).

Sales is of course a relatively easy role to model because these roles are directly related to revenue. The model can also be applied to any role, even service roles. The opportunity cost of running your customer service team too lean has a financial impact from decreased NPS, lost customers, or higher returns. The goal of this article is to inspire you to engage with your finance people and work through the numbers.